GHS on Deemed Dividends

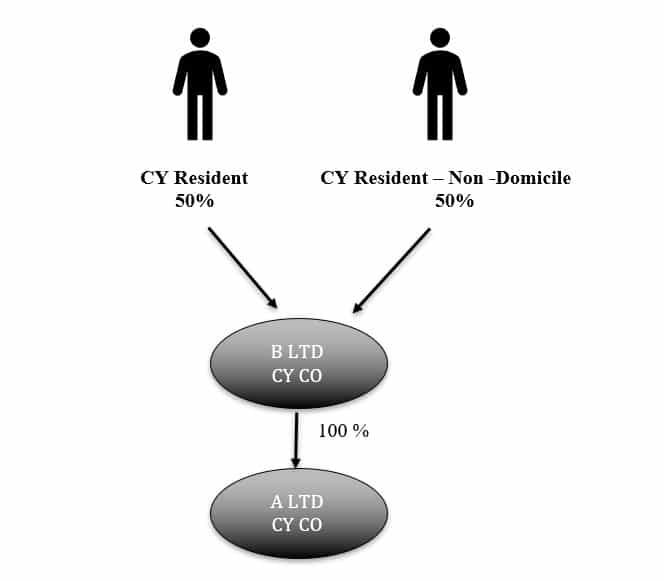

In accordance to the Cyprus Health Insurance Organization in cooperation with the Inland Revenue Department; Deemed Dividends declared by a Cyprus Tax Resident company ( A Ltd) are subject to GHS contribution on 100% of the Deemed Dividend amount if the shareholding structure is as shown below:

CY Resident: Resident in accordance with the Income Tax Law N.118(I)

CY Resident – Non-Domicile: Cyprus Resident, who does not have its domicile in the Republic in accordance with the Special Defence Contribution Tax Law N.117(I).

If you want to work with professionals who provide exceptional quality standards of services in Cyprus, the simplest way is to fill in this contact form.

We will analyze your case and advice you on:

- What company structure suits you best,

- What is the best Tax solution(s) for your business,

- What Banking and cash flows arrangements available.

We will take you through a step by step process from A to Z in creating the perfect business in Cyprus.

Can’t wait any longer? Fill in the form and submit your inquiries make your first step and we will deal with the rest.

Become even more successful by working with accountants you can count on and be among the thousands that already did.

If you want to work with professionals who provide exceptional quality standards of services in Cyprus, the simplest way is to fill in the contact form below.

We will take you through a step by step process from A to Z in creating the perfect business structure in Cyprus.

Can’t wait any longer? Become even more successful by working with accountants you can count on and be among the thousands business that already did.